net cash flow formula

F r e e C a s h F l o w O p e r a t i n g C a s h F l o w C a p i t a l E x p e n d i t u r e s. To calculate net cash flow this way youll use the following formula.

What Is Net Cash Flow Definition Meaning Example

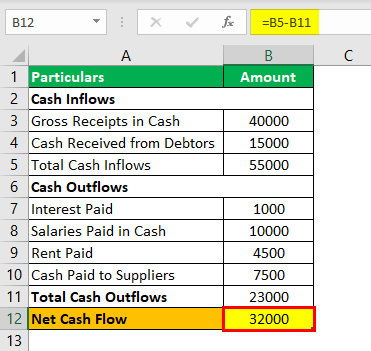

Put simply NCF is a businesss total cash inflow minus the total cash outflow over a particular period.

. Discounted Cash Flow is a term used to describe what your future cash flow is worth in todays value. Net cash flow cash inflows - cash outflows. But you can also separate cash flow by category.

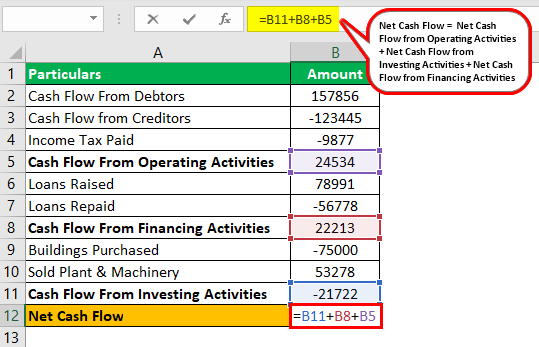

Step 3- The Calculation Net Cash Flow from Investing Activities. Cash inflow is the cash generated from stocks contributions borrowing loan and investment income. Net cash flow operating activity cash flow CFO investment activity cash flow CFI financing activity cash flow CFF.

What is the Net Cash Flow Formula. Free Cash Flow Example. Cash outflow in finance is the amount of cash paid towards debt to reacquire equity buy back stocks or to divide the amount of cash within the number of shareholders equally.

This means that Company As net cash flow over the given period is 80000 indicating that the business is relatively strong and should have enough capital to invest in new products or reduce debts. Net Cash Flow CFOCFICFF. Operating Activities 30000.

The above formula is the most typical way to calculate net cash flow because it can be done from a cash flow statement in Excel. NCF Net cash flows from operating activities Net cash flows from investing activities Net cash flows from financial activities. N P V t 0 n R t 1 i t where.

Free cash flow FCF net operating profit after taxes net investment in operating capital. Net cash flow cash receipts - cash payments. Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance.

Repeated periods of positive net cash flow are a good sign that your business is ready to expand whereas repeated periods of negative net cash flow can be a sign that your business is struggling. The formula is. Begin aligned text Free Cash Flow text Operating Cash Flow.

The simple formula above can be built on to include many different items that are added back to net income such as depreciation and amortization as well as an increase in accounts receivable inventory and accounts payable. It can also be expressed as the sum of cash from operating activities CFO investing activities CFI and financing activities CFF. The formula for net cash flow calculates cash inflows minus cash outflows.

Operating financial and investment. A mathematical representation of the above formula of net cash flows is as follows. Formula for net cash flow.

Calculation of net cash flow can be done as follows. Net Cash Flow Cash Flow from Operating Activities Cash Flow from Investing Activities Cash Flow from Financing Activities. Financial professionals calculate net cash flow with the following formula.

Net cash flow cash inflows cash outflows. Net Cash Flow Formula. It is calculated by subtracting a companys total liabilities from its total cash.

Operating Cash Flow Net Income All Non-Cash Expenses Net Increase in Working Capital. Heres how this formula would work for a company with the following statement of cash. Cash Flow Cash from Operating Activities - Cash from Investing Activities - Cash From Financing Activities.

Net Cash Flow Net Cash Flow Net cash flow refers to the difference in cash inflows and outflows generated or lost. R t net cash inflow-outflows during a single period t i discount rate or return that could be earned in alternative investments t. An extended formula is.

Net Cash Flow 100 million 50 million 30 million. Cash receipts minus cash payments. The net cash flow formula helps reveal if a business is performing well or in danger of going bankrupt.

100000 40000 60000 80000. NCF total cash inflow - total cash outflow. Net Cash Flow Operating Cash Flow Financing Cash Flow Investing Cash Flow.

Company ABC spent 300000 on warehousing equipment last year. Excel Profit and Loss template. Investing Activities 5000.

Operating Cash Flow Net Income Depreciation Stock Based Compensation Deferred Tax Other Non Cash Items Increase in Accounts Receivable Increase in Inventory Increase in Accounts Payable Increase in Accrued Expenses Increase in Deferred Revenue. Net cash flow can be derived through either of the following two methods. Therefore the company generated operating cash flow and free cash flow of 221 million and 93 million respectively during the year 2018.

Cash flow is the inflows and outflows from operating activities investing activities and financing activities. This appears at first to be the most direct method of deriving net cash flow but the accounting transaction recording system does not aggregate or report information in this manner. Free Cash Flow Net Income Depreciation Change in Working Capital Capex.

The Net Cash Flow Formula. Lets look at a free cash flow scenario utilizing the formula above. Free Cash Flow 227 million 32 million 65 million 101 million.

Liquid AssetsLiquid Assets are the business. On its annual cash flow statement for 2020 Company ABC reports 700000 in operating cash flow. Cash flow forecast example.

The net cash figure is commonly used when evaluating.

Cash Flow Formula How To Calculate Cash Flow With Examples

Net Cash Flow Formula Step By Step Calculation With Examples

Dheeraj On Twitter Net Cash Flow Formula Step By Step Calculation Of Net Cash Flows Https T Co S7ljmhkklj Netcashflowformula Https T Co Fhpqthqrmg Twitter

Net Cash Flow Formula Calculator Examples With Excel Template

Net Cash Flow Formula Calculator Examples With Excel Template

Net Cash Flow Formula Step By Step Calculation With Examples

Net Cash Flow Formula Step By Step Calculation With Examples

0 Response to "net cash flow formula"

Post a Comment